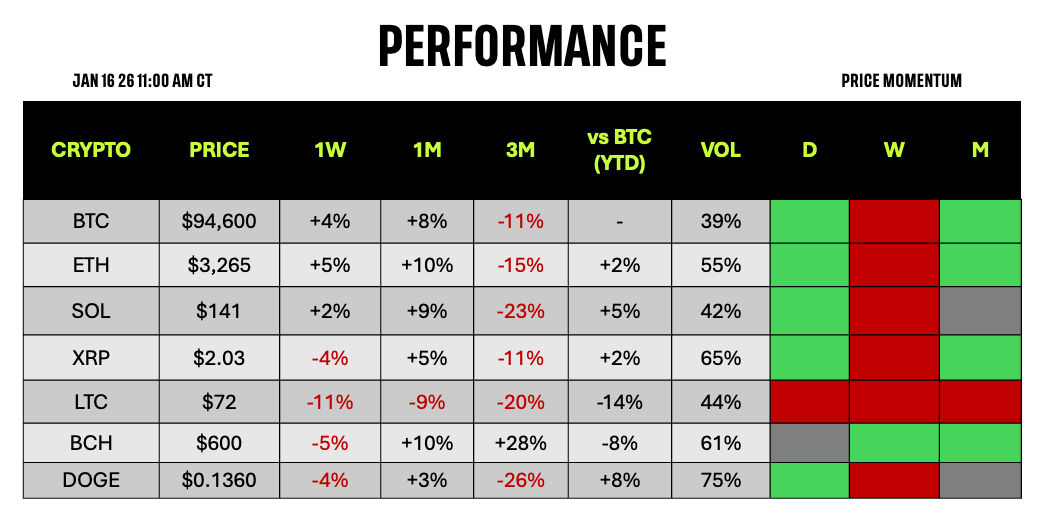

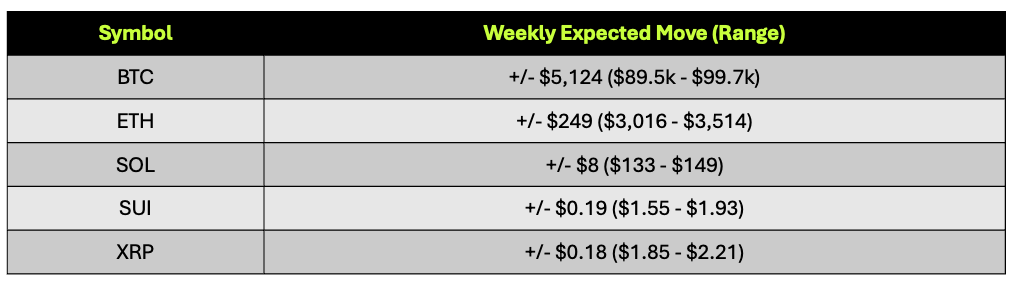

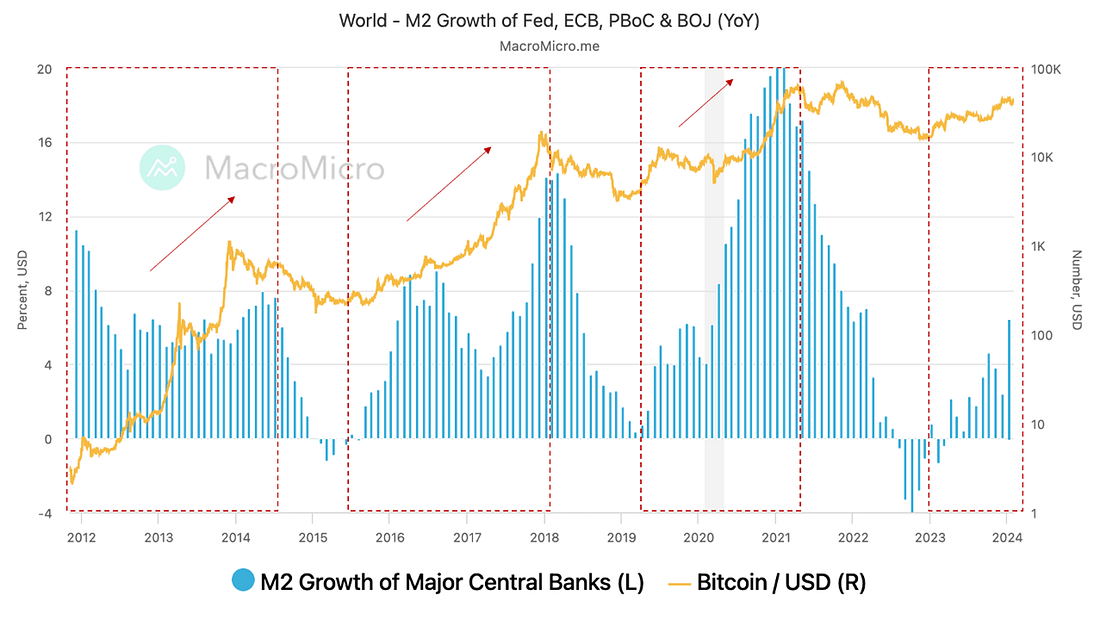

Welcome to tastycrypto Don’t recognize this sender? Unsubscribe with one click tastycrypto recently imported your email address from another platform to Substack. You'll now receive their posts via email or the Substack app. To set up your profile and discover more on Substack, click here. Hello my tasty friends, I hope you’re all having a wonderful start to your weekend. As you can see, we’ve got a refresh of the newsletter and we’ve moved to Substack. More content coming soon on this platform. Market ObservationsCrypto showed some bullish signs this week, but the multi-month trend remains bearish. Crypto assets haven’t really been in play recently, with precious metals and AI still capturing most of the attention. Volatility continues trending lower with BTC implied vol back in the 30s and ETH at 55%. Short-term price momentum is back to bullish, but I’d like to see 95k hold and weekly price momentum flip from bearish to bullish before I get too excited. Over the next year, I think market conditions support higher prices (read below), but remember bottoming is a process. Now, regardless of the weekly moves we track, I want to discuss why I believe the setup exists for BTC to trend higher in the coming months. In short, the liquidity pump has been turned on. Soaking in liquidityOn Wednesday, I sat down with my friend and fellow cave member Dan Cecilia to film a pilot for a series we’re working on. Towards the end of our conversation we debated whether BTC revisits its recent lows or hits a new high next. I have a bullish thesis and I want to highlight why I think we go higher. It comes down to a simple point. Liquidity. Which in my view, is the only thing that matters. Liquidity is going to pump throughout the financial system. By some estimates, there’s a $4-8 trillion injection coming in 2026 due to lower interest rates, fiscal spending, and massive debt refinancing. To the later point, roughly 30% of US debt needs to be rolled this year. Given this setup, I think there’s an increasing probability we hit a new high in 2026. Crypto is usually very sensitive to financial conditions. When liquidity is expanding, it can quickly jump higher, but when liquidity contracts, there’s often a violent downside reaction. The rate of change of liquidity matters. It has increased during 2025, and for now, I think the rate of liquidity (y/y growth rate of global M2 as proxy) continues to move higher given the 2026 setup. This should support BTC, at least it has historically per the chart below from MacroMicro that shows the correlation between the price of BTC and liquidity expansions/contractions. You’re seeing it now.

This is a macro setup where crypto can trade higher. Financial conditions are easing within a positive economic environment, and this typically supports asset prices.

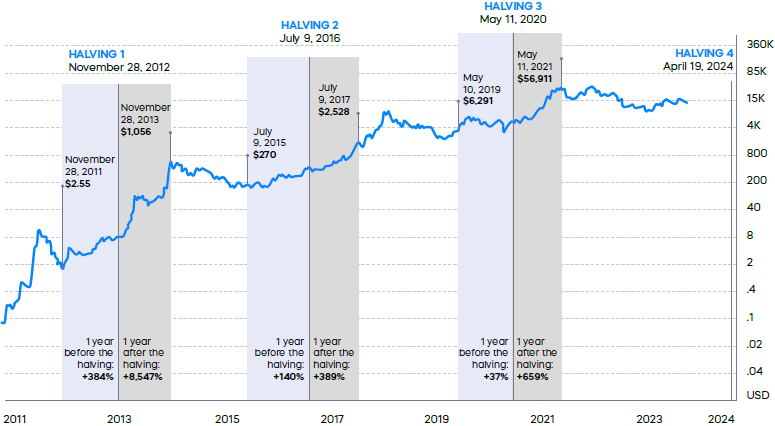

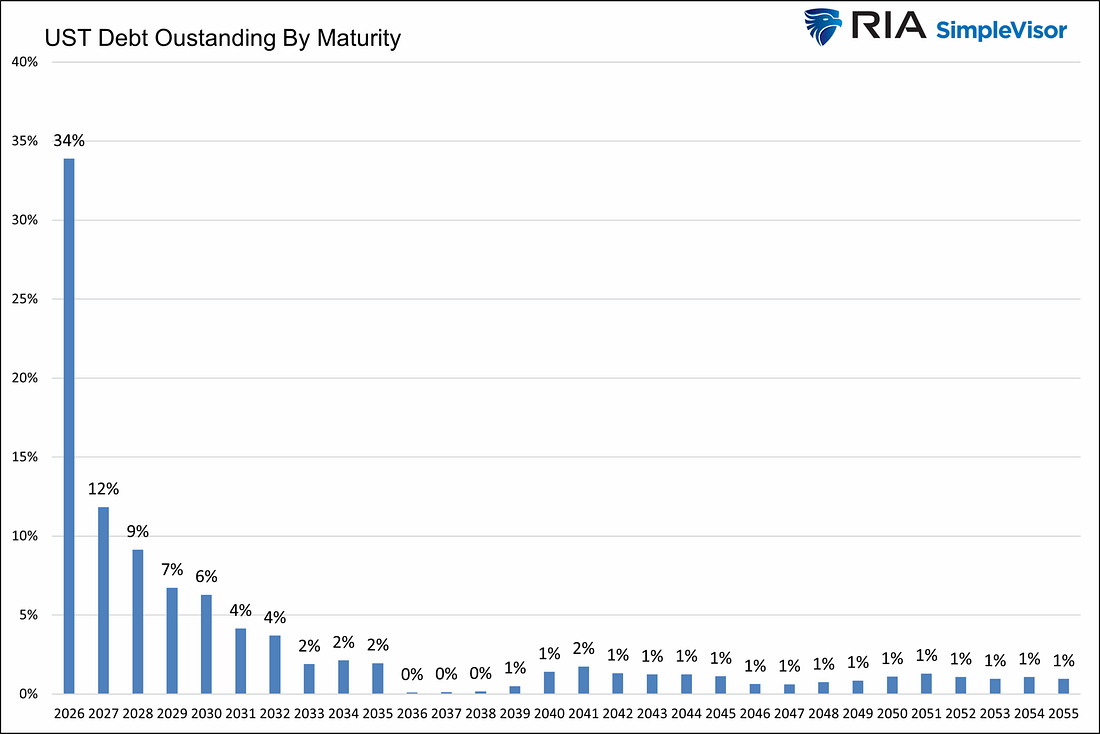

Halving Cycle vs Debt Cycle?Something to ponder. The crypto market has historically followed a 4-year price cycle, with tops occurring roughly 12-18 months after each BTC reward halving date. The chart below from ProShares highlights this across the first three halving cycles. Now, consider this cycle. We put in an ATH on October 6 2025, around 18 months after the April 2024 halving. Looks awfully familiar. If it’s truly the halving that drives price cycles, then it would seem the top is in. What if the halving is a distraction? Post-2008, debt issuance and subsequent rollovers have also followed a cycle, which coincidentally is about 4 years. This stems from the policy response to the 2008 financial crisis. Around the same time Bitcoin launched, central banks and governments began issuing large amounts of debt at low rates with maturities of 3-5 years. This created synchronized refinancing waves, and requires management via policy levers, hence the current pressure on the Fed to cut short-term rates. The average debt maturity of the US Treasury has expanded to 72 months as of 2025, but large issuance during low-rate periods (e.g., 2008-2010 and 2020-2021) created rollover clusters every 3-5 years, previously overlapping with the halving cycles we’ve observed in Bitcoin. Historically these large rollovers and the halving cycles roughly aligned, but this time the debt cycle is elongated with 30% of outstanding debt maturing in 2026, a 5-year cycle following massive debt issuance when rates were very low during 2021. If debt is the driver, the cycle might not be over. What else has our attention?People are using stablecoins in their everyday lives. Crypto-linked credit card spending hits $18 billion annualized. Digital asset treasury companies (DATs for short) are quietly executing on their missions. Bitmine invests $200 million in MrBeast and future DeFi platform More crypto companies are planning to go public in 2026. How crypto IPOs will change in 2026 Summary

That’s it for this week. Subscribe for more tastycrypto content, and as always… Keep your head on a swivel. Stay tasty, Ryan Disclaimer: None of this is to be deemed legal or financial advice of any kind and are solely the opinions of the author. tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. and tastytrade, Inc. Neither tastylive, Inc. nor tastytrade, Inc. are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved, including volatile market prices, illiquid market conditions, lack of regulatory oversight, market manipulation, and other risks. Social: Crypto trade ideas and more content on YouTube. Follow us on X. |

Passive Income

Eddy XRP Dashboard

Eddy XRP Dashboard

💰 Harga XRP Live (TradingView)

📈 Probabilitas ETF XRP (Polymarket)

📰 Berita Terbaru

🧭 Sentimen Pasar

Sabtu, 17 Januari 2026

Soaking In Liquidity

Postingan Populer

-

Sidoarjo Perum Gedangan Indah asri Ketajen Gedangan Harga 300.000.000 mau ?? atau yang ini ajah?? https://rumahdijual.com/kota-lain/...

-

ARGENT PARC SIDOARJO New Flourishing Sidoarjo ARGENT PARC SIDOARJO Developed by PT Avila Prima Intra Makmur ARGENT PARC S...

-

Untung banyak! Berkat kebijakan baru, PNS pun bisa mengantongi THR berkali-kali lipat ...

-

Rumah BUMI SUKO INDAH | Click for more Transaksi Jual Rumah BUMI SUKO INDAH cari rumah dekat masjid ? Klik>> https:...

-

Rumah terbaru untuk pencarian Anda. Jadi yang pertama menghubungi pengiklan! ...

-

Check the three coins that have a strong chance of outperforming the market 👉 ...

-

Investigating - 1 component affected - We are aware of a partial outage of some of our... ...