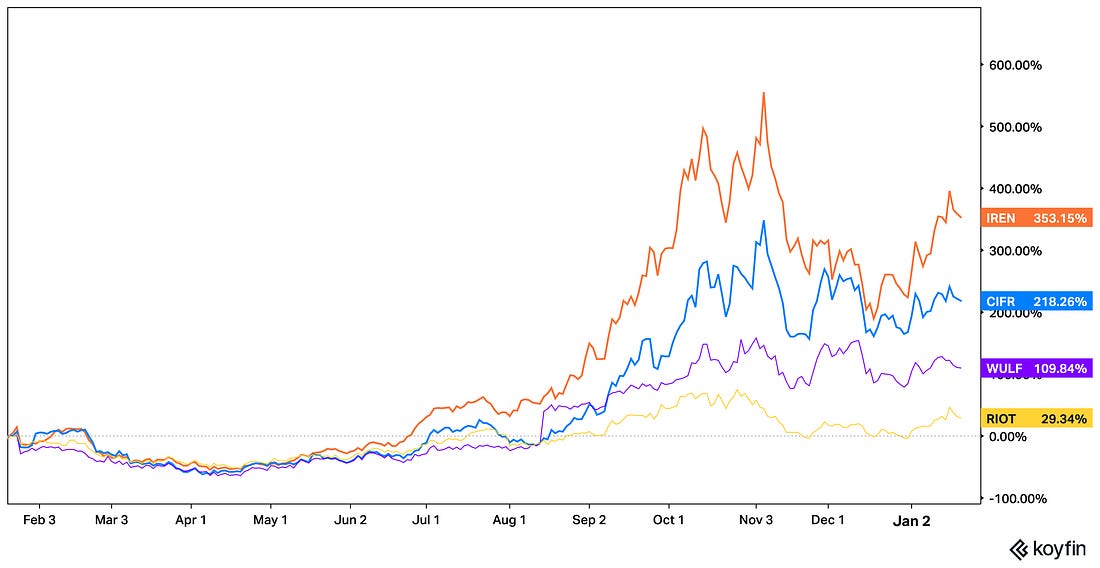

Crypto Miners Pivoting to AI Could Unlock Billions in ValueDiversifying away from mining could drive 10-25x more revenue per kWh.Hello my tasty friends. I hope you’re all having a wonderful start to your weekend. Crypto markets remains choppy and have experienced some short-term Trump induced vol this week, but what else is new? We think the liquidity backdrop is positive, and our long-term view remains the same, but unless we can seriously hold above 95k, the path remains rangebound/lower for now. Is what it is, but if you’ve been with us since 2022 when we started writing, you’re playing the long game, and that has certainly been rewarding. While we wait on an eventual move out of this 85k-95k BTC range, we want to highlight other compelling opportunities we’ve been spending time researching, specifically crypto miners pivoting to AI, and consumer DeFi app revenue growth. Dan and I outline these below, as part of the new content series we’re developing for tastylive. This week, I’m highlighting crypto mining companies that are evolving into AI infrastructure plays, and Dan is covering the consumer DeFi apps with real revenue growth which are positioned to return value to token holders. You can watch the first video for a more in-depth conversation here too. Crypto Miners Are the New AI CompaniesBitcoin mining is a tough business. It requires massive compute, access to abundant cheap energy, and revenue is directly correlated to the BTC price. Unless bitcoin is ripping higher after each halving, it’s difficult for miners to turn a meaningful profit. These stocks are high vol bitcoin proxies, which do well during bull markets but typically underperform otherwise. Now, if only there were a way for these companies to diversify their revenue away from a 100% reliance on BTC… Following the post-2024 halving and margin compression within the industry, many legacy miners are beginning to pivot their infrastructure towards AI, which is not only a more profitable business but could reset the trajectory of their stock prices, much higher. Investment ThesisGiven the infrastructure most bitcoin mining companies utilize, they’re well positioned to meet the insatiable demand for high-performance computing workloads amid the AI boom. Many have established grid connections and cheap power contracts that are seen as gold in the AI era. This creates an opportunity to identify legacy bitcoin mining companies in the process of diversifying their revenue away from bitcoin, towards higher margin, long-term contracts with AI hyperscalers (MSFT, GOOGL, AMZN, etc.), which by some estimates could drive 10-25x more revenue per kWh compared to mining alone. As of January 2026, there have been a number of deals between miners and AI focused names, In total bitcoin miners have announced approximately $65 billion worth of deals to date. Iris Energy (IREN) and Microsoft (MSFT) - 5-year $9.7 billion Hut 8 (HUT), Fluidstack and Anthropic - 15-year $7-18 billion (w/renewal) Cipher Mining (CIFR) and Amazon (AMZN) - 15-year $5 billion Ciphers Mining (CIFR), Fluidstack, and Google (GOOGL) - $3 billion Riot Platforms (RIOT) and Advanced Micro Devices (AMD) - $1 billion The market has rewarded the moveLike most AI related names, the stocks of miners making the switch to AI have exploded higher, though they have pulled back in recent months. Looking ahead, analysts are now projecting revenue from bitcoin mining to fall from 85% of total revenue today to only around 20% by 2027. - This seems aggressive, but given the increasing demand for AI related compute and CAPEX growth within the industry, there could be a lot of value unlocked. We’ve surfaced a few tickers above, but as always do your own research here. This is a developing theme and we think it makes sense given the demand we’re seeing, but also keep in mind, many of these companies have taken on large amounts of debt to fund the infrastructure buildout required to meet this demand. These names trade at a relatively high volatility and also face competition from other traditional datacenter providers and others entering the market to ride the AI boom. No investment is without risk of course. The Revenue Meta - Is 2026 the year that token holders finally accrue value?The Revenue MetaIf you have been following our writing or tuned in to the first episode of our newly launched podcast on tastylive, you have heard us talk about the growing investment thesis focused on protocols or applications that generate real, sustainable revenue from on-chain usage. This revenue can be generated from transaction fees, lending yields, or trading volumes and is returned to token holders via token buybacks, burns (reducing supply), or some form of revenue sharing via staking. This represents a shift away from hyper-speculative, narrative-driven momentum assumptions that had no true fundamental value or way to provide value back to token holders. We believe 3 key events are the signal that provides the foundation for the shift towards revenue and token holder alignment. 1. UnificationThe Uniswap “Unification” proposal was announced, which turned on the fee switch for the Uniswap protocol, thus aligning incentives between the centralized Uniswap Labs entity, Uniswap Foundation and $UNI token holders. This proposal was executed on December 27th, 2025, which retroactively burned 100 million $UNI tokens and turned on protocol fees that will burn $UNI going forward. We covered this proposal extensively in our previous newsletters which you can reference here. 2. Avara Labs vs Aave Foundation “Brand Assets” DebateA dispute within the AAVE ecosystem has brought to light the tension between the governance community (foundation) and the centralized labs team that drive the execution of the product. This dispute centers on who controls the brand and related assets and was triggered by a switch in its trade execution routing, which resulted in fees from swaps flowing to the centralized labs entity rather than the DAO treasury. This governance battle is another example of token holders demanding alignment between centralized entities that develop protocols and the value these protocols generate. 3. Regulatory ClarityWith the passing of the GENIUS Act and continued movement on the CLARITY Act, which will provide a proper market structure framework for US-based crypto and DeFi companies, we are seeing this shift playout on the regulatory front as well. We believe this is an inflection point for protocols to finally return value to token holders. To capitalize on this growing shift, we have compiled a list of tokens that will benefit the most. Top Revenue Generating Tokens for 2026Here are our top token ideas for 2026 that fit the revenue meta thesis. Data provided by DeFi Llama. NFA DYOR That’s it for this week. If you like what we’re doing here at tastycrypto, make sure to subscribe (if you haven’t already) and check back each week for more trade ideas and investment themes. Up next: agentic investing and the future of defense technology. Until then, keep your head on a swivel, and as always… Stay tasty! Ryan Social: Crypto trade ideas and more content on YouTube. Follow us on X. Disclaimer: None of this is to be deemed legal or financial advice of any kind and is solely the opinion of the author. tastycrypto is provided by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. and tastytrade, Inc. Neither tastylive, Inc. nor tastytrade, Inc. are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors. |

Passive Income

Eddy XRP Dashboard

Eddy XRP Dashboard

💰 Harga XRP Live (TradingView)

📈 Probabilitas ETF XRP (Polymarket)

📰 Berita Terbaru

🧭 Sentimen Pasar

Sabtu, 24 Januari 2026

Crypto Miners Pivoting to AI Could Unlock Billions in Value

Postingan Populer

-

Sidoarjo Perum Gedangan Indah asri Ketajen Gedangan Harga 300.000.000 mau ?? atau yang ini ajah?? https://rumahdijual.com/kota-lain/...

-

ARGENT PARC SIDOARJO New Flourishing Sidoarjo ARGENT PARC SIDOARJO Developed by PT Avila Prima Intra Makmur ARGENT PARC S...

-

Untung banyak! Berkat kebijakan baru, PNS pun bisa mengantongi THR berkali-kali lipat ...

-

Rumah BUMI SUKO INDAH | Click for more Transaksi Jual Rumah BUMI SUKO INDAH cari rumah dekat masjid ? Klik>> https:...

-

Rumah terbaru untuk pencarian Anda. Jadi yang pertama menghubungi pengiklan! ...

-

Check the three coins that have a strong chance of outperforming the market 👉 ...

-

Investigating - 1 component affected - We are aware of a partial outage of some of our... ...