💥 Linea, Base and Arbitrum among the chains with interesting opportunities ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

gm Web3 explorers, If you're looking for DeFi opportunities, it seems there's plenty on L2 networks. Scaling solutions like Linea, Base and Arbitrum are home to thriving multichain solutions, and upcoming native projects. Looking to farm crypto? That's where you need to be! Let's go! 📡🔵 |

|

|

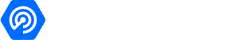

Perpetual trading with up to 100x leverage |

GMX wants to offer perpetual trading in the same way centralized exchanges do this. The DeFi platform exists on Avalanche mainnet, and on Arbitrum - the popular L2 network on top of Ethereum. Through GMX you can earn around 30% APY through fees generated from the GMX V1 and V2 markets. |

|

| 🟦 Linea thrives with $828 million TVL |

Linea recorded an average of 316,729 daily Unique Active Wallets interacting with dapps in Q3 2024, marking a 7% increase from Q2, reflecting continued user engagement. With $828 million in TVL, DeFi plays a major role in the initial success of Linea as an L2 network. |

|

|

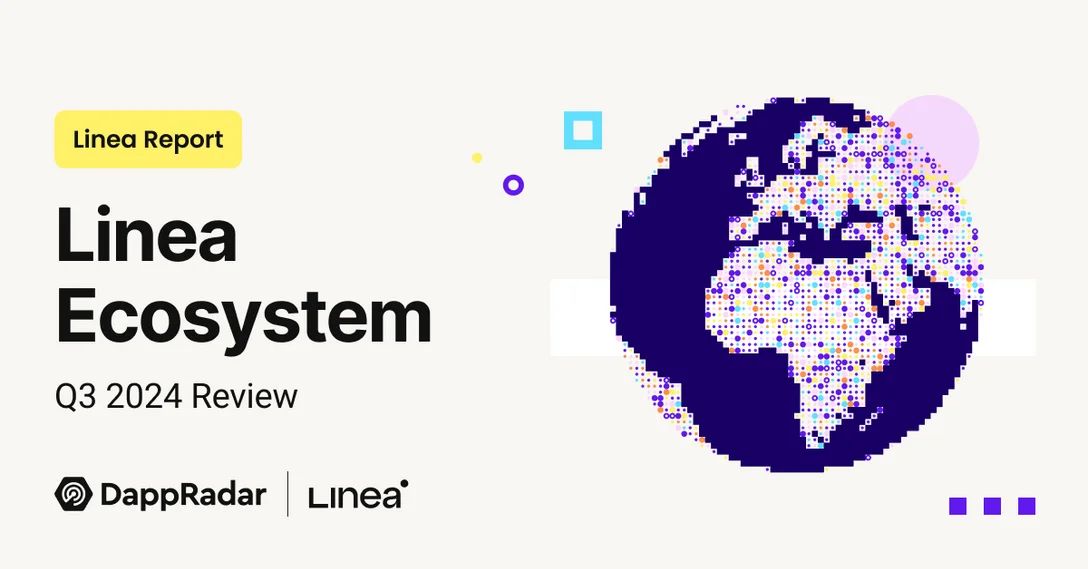

a competitive ecosystem of Automated Liquidity Managers (ALMs) and strategists | In the past month, Lynex increased its TVL by 12% reaching almost $30 million. The price of the native token pumped 23% to $0,0569. The platform allows single-sided liquidity provision, while they offer rewards up to 209% APR for certain liquidity pairs. |

|

|

Lend, borrow, build your tomorrow |

Lending platform Moonwell launched on Moonbeam, but is now finding huge success on Base. They for example offer 23% APY on USDC on Base, or 11% on EURC. Riskier opportunities even come with bigger rewards. |

|

|

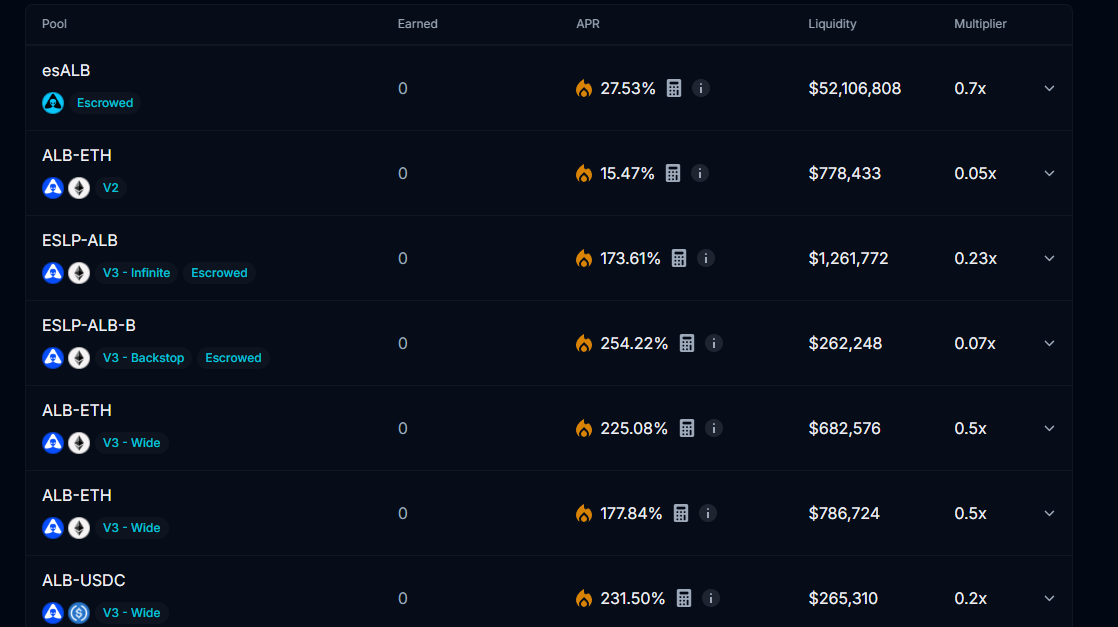

Trade, earn and get rewarded for holding ALB |

In the past 30 days Alien Base, built on Base, processed $93 million in volume. That's a 606% increase. It's not weird to see TVL pumping 245% to $87.9 million, while the native ALB token is in heavy demand with a 284% price increase in the past month. Currently certain riskier liquidity pairs offer 254% APR |

|

|

btw. you don't have to rely on this newsletter to get some alpha. By utilizing DappRadar and its suite of services, you can find the alpha yourself. Go to our Rankings, apply filters, and find interesting projects based on onchain data. Or join Quests to explore dapps looking to attract an audience. LFG! 📡🔵 |

|

|

Have a great day,

DappRadar Team

💙 |

©2024 DappRadar

K. Donelaicio g. 60

Kaunas Kaunas LT-44248

LITHUANIA

|

The email was sent to clickcomp4more.hrgrmh@blogger.com. To no longer receive these emails, you can unsubscribe. You can read our privacy policy here. |

|

|

|