gm Web3 explorers, Crypto is hard right now, but Web3 is filled with opportunity. In this newsletter we look at some dapps with great earning potential through farming and airdrop activities. Let's go! 📡 |

|

|

This newsletter is powered by... |

|

|

Explore the latest and upcoming Airdrops on DappRadar |

The Airdrops overview page gives every DappRadar member free access to airdrop guides. These guides help you to optimize your activity for a potential airdrop. |

|

|

🎉 Crypto Run on Oasys biggest gainer of the week |

Out of all the 18,000 dapps tracked by DappRadar, Crypto Run on Oasys' Saakura Verse made the biggest gains in terms of active wallets. The dapp increased its number by 3,751% to 10,890 active wallets. The numbers shut up Thursday, Friday and Saturday last week, before going back to lower numbers. Crypto Run is a Web3 take on the popular mobile genre of endless runner games, using references to crypto and trading. |

|

|

Start gaming through Raijin and earn rewards |

SPONSORED -- Raijin.gg is one of the leading engagement platforms for gaming that utilizes blockchain technology, and they've managed to push both web2 and web3 games up the charts on Steam. In true Web3 fashion, they've distributed over $250,000 in prizes to their community in the past 3 months.

👀 Play games and earn achievements on Steam to win from a prize pool

⚡ Over 80,000 wishlisted games on Steam through the Raijin platform

💰 Over $250,000 in prizes in the past 3 months Read more in our article about Raijin, or visit the platform directly through the link below. 👇 |

|

|

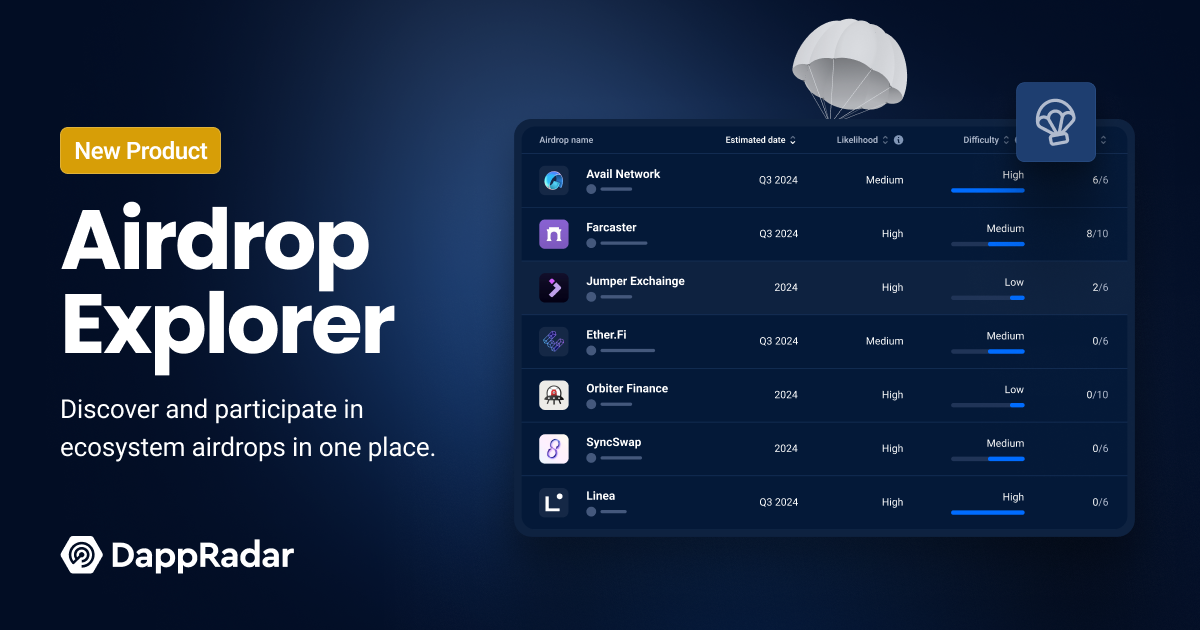

Abstract almost hitting record high numbers |

Abstract has attracted 191,410 active wallets in the past 7 days, up 649% from the week before. Numbers peaked on June 26, almost hitting a record with 95,150 active wallets on that day. Jumper Exchange and Moonshot saw noticeable increases, but NFT marketplace OpenSea is the real big performer. On Abstract they attracted 173,520 active wallets, up 3,681%. Low value NFTs on Abstract, such as Bozo, Punkism and Abstra Universe, are among the most traded NFT collections. Users supposedly farm for an airdrop on Abstract, while also collecting points on OpenSea. Win win. |

|

|

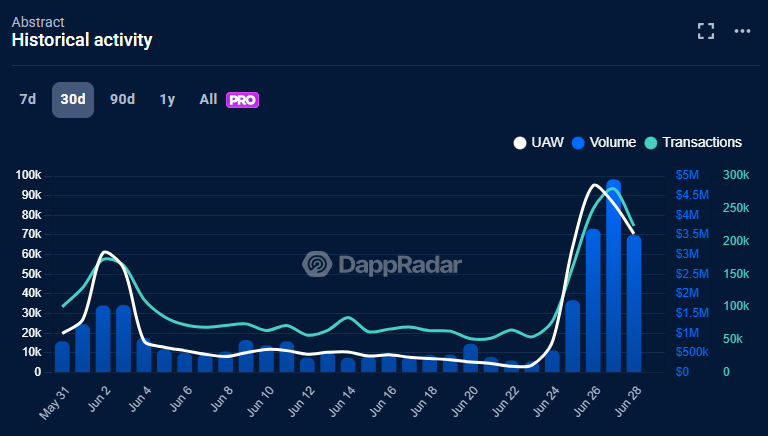

Trading volume on OpenSea up 724% to $32.3 million |

With Abstract hitting OpenSea, and point farming still being a thing, OpenSea managed to grow its trading volume by 724%. In total, the NFT marketplace managed to process 1.19 million sales for a total volume of $32.39 million. The biggest sales happen in collections like BAYC, Art Blocks and artworks by XCOPY. However, the most sold NFT collections are all on Base and Abstract. The top 5 collections are responsible for over 800,000 sold assets, which is roughly 75% of all sold assets. Despite these high numbers, these five collections were good for only $11.5 million in volume. So in short, 75% of all sold NFT were responsible for 35% of the total trading volume. This highlights the low value of the most traded collections. Chimpers have the lowest average price at $6.50, while Abstra Universe NFTs go for $19.84 on average. |

|

|

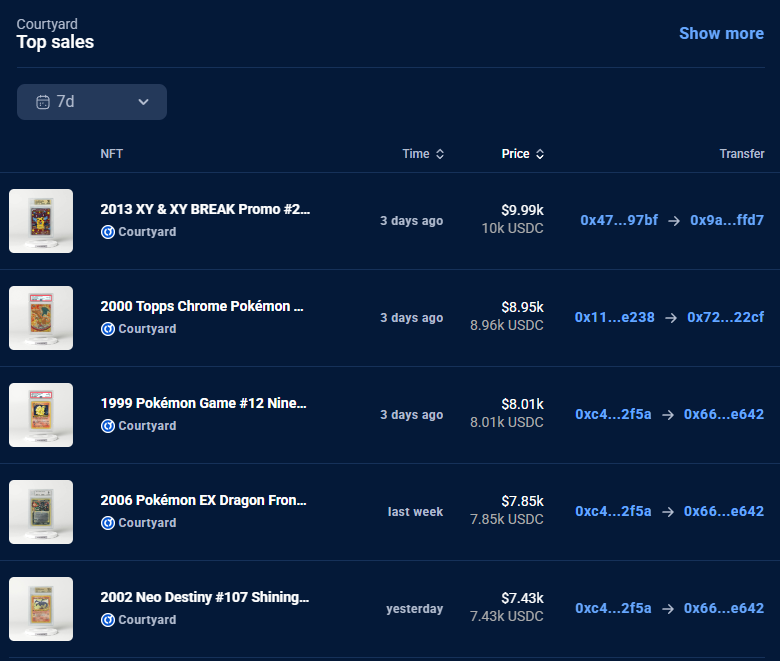

Physical trading cards lead the NFT market |

NFTs are dead? No. And they aren't only popular because of airdrop farming either. Courtyard is the new king in town, and the NFT marketplace allows users to buy and sell tokenized trading cards. This includes sports cards, but also Pokémon cards. The collection did $8.83 million in the past week, up 11% from the period before that. The average price went up by 23% to $94. In the past week, the platform attracted 2,210 traders. A small 15% increase from the week before. The most valuable trades on Courtyard, all come from the Pokémon collection. The most expensive one sold for 10,000 USDC. The most expensive sports collectible was the 2020 Panini Rookie card for Justin Herbert, which sold for 12,979 MATIC or $2,300. |

|

|

Earn $BJORN and $ALICE with My Neighbor Alice |

Welcome to the vibrant world of My Neighbor Alice, a social MMO adventure game now open to all. The public release of A New Adventure invites players to explore the enchanting Lummelunda archipelago. With no downloads needed, anyone can dive in through their browser. Get ready to build, craft, and connect in this blockchain-powered paradise. |

|

|

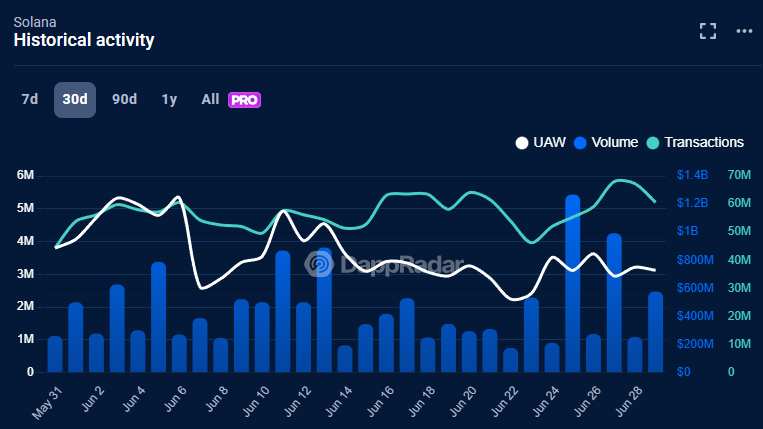

Solana doubled dapp volume to $2.27 billion |

The dapp ecosystem on Solana has increased the volume flowing into its smart contracts by 114% to more than $2.27 billion. That's volume from users staking, swapping, buying, loaning and providing liquidity. Marinade Finance ($1.15 billion) and Jito ($755 million) were among the biggest contributors, followed by Pump.fun, Jupiter Exchange and Raydium. |

|

|

Don't forget to explore gaming through Raijin to earn rewards.. |

|

|

Have a great day,

DappRadar Team

💙 |

©2025 DappRadar

K. Donelaicio g. 60

Kaunas Kaunas LT-44248

LITHUANIA

|

The email was sent to clickcomp4more.hrgrmh@blogger.com. To no longer receive these emails, you can unsubscribe. You can read our privacy policy here. |

|

|

|